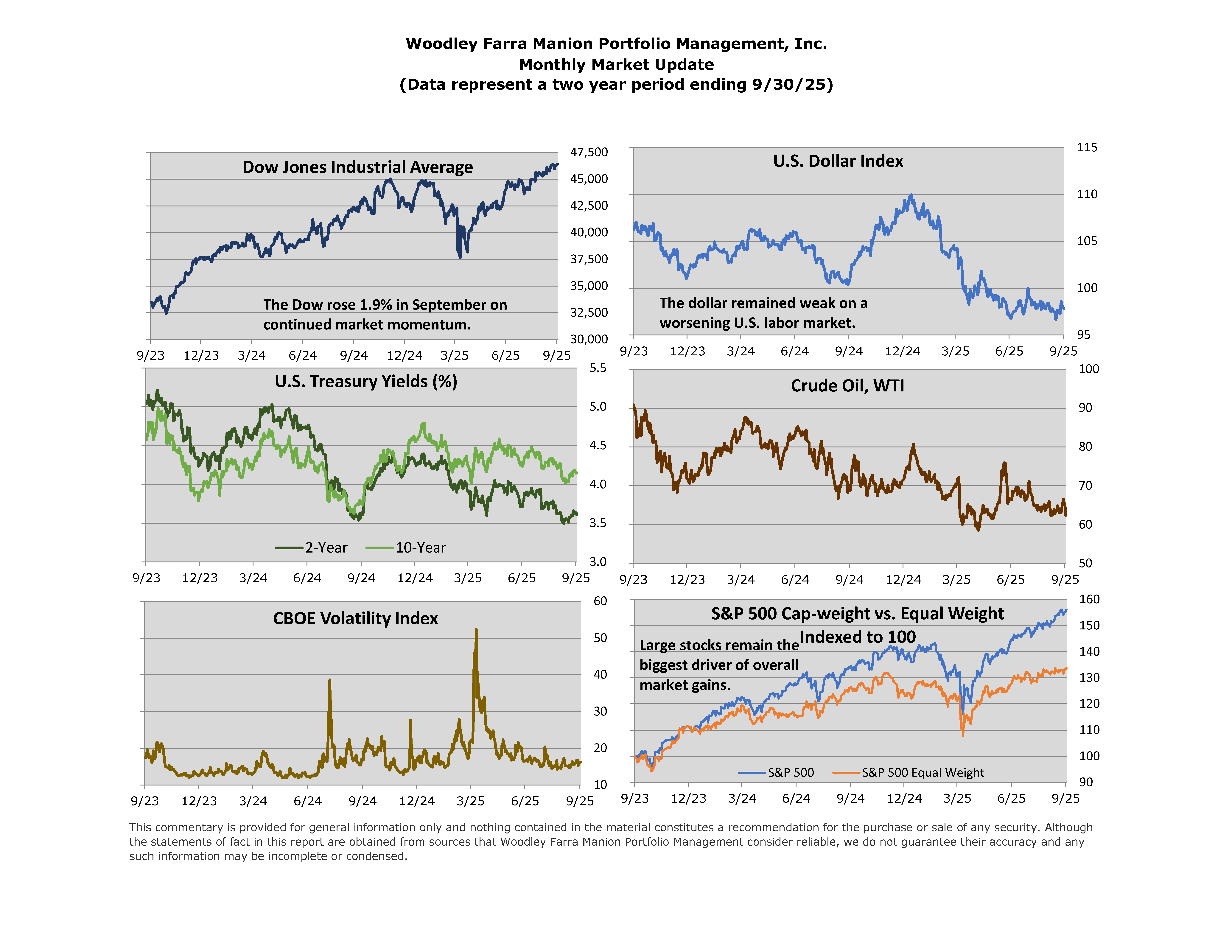

The third quarter saw continued momentum in the AI trade, falling interest rates, and more trade deals reached with foreign nations. In September, the Fed announced its first rate cut of 2025, cutting the policy rate by 0.25%. This cut was widely expected given weak employment data. As rate cuts materialize, stocks and the economy could see near-term tailwinds from lower borrowing costs.

Lately, meme stocks, unprofitable tech, crypto companies, and AI names have seen huge gains largely from speculative bets. In AI, some of the biggest names, like OpenAI’s Sam Altman, have raised concerns. Altman was quoted as saying “Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes.” He went on to stress the long-term innovative nature of AI and suggested overoptimism mainly applies to competitors with weak fundamentals. Mark Zuckerberg, CEO and founder of Meta (Facebook), recently said he would rather overspend by hundreds of billions than come up short in the AI race. This FOMO is adding fuel to the massive capital expenditure growth among the AI “hyperscalers.” The average hyperscaler, which consists of Microsoft, Amazon, Alphabet (Google), Meta, and Oracle, has doubled their capital expenditure as a percentage of sales from about 11% five years ago to 22% today. Rising capital expenditure rewards investors when the returns on said investments follow suit. The question today is if this massive wave of investment can yield the returns necessary to justify current valuations. Fiber optic/internet infrastructure investment in the 1990s was in the hundreds of billions, but resulted in excess capacity, deflationary pricing, and poor returns for investors in the 2000s. Investors were correct about a bright new technology (the internet), but many lost tremendous amounts of money nonetheless.

Large AI investments and enthusiasm pose a risk to major indices like the S&P 500, given the elevated exposure. It also means there are opportunities for prudent investors. With so much hype around a select few names, there are whole sectors that have been overlooked by investors. Like the internet, AI is likely going to be a major innovation that unlocks new efficiencies and economic productivity. However, like the internet, there may be some bumps, and the current players may look very different or not exist in the future. Time will tell.

We are honored to be recognized as a CNBC top 100 financial advisor for the sixth consecutive year! We celebrate this accomplishment with you and thank you for partnering with us.