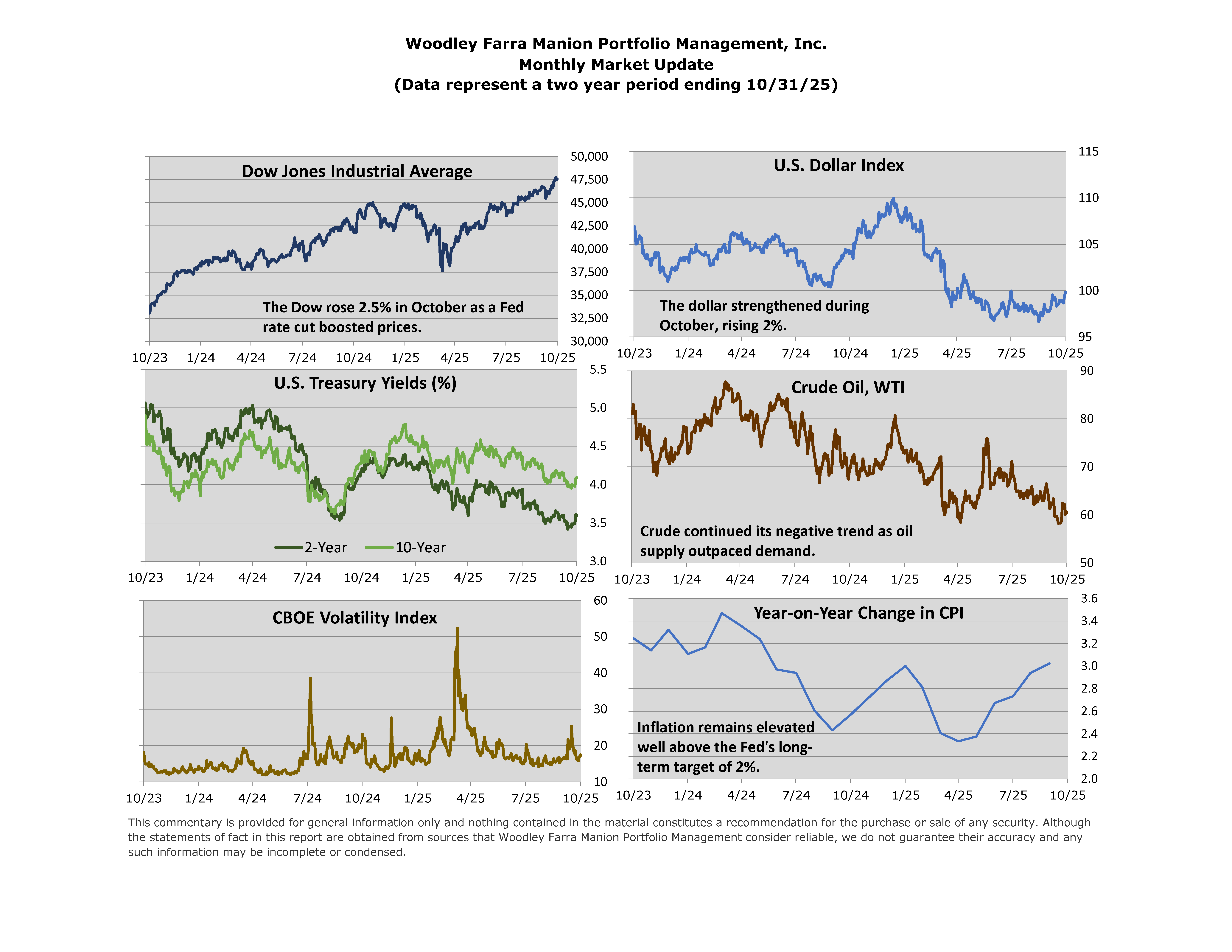

The Federal Reserve delivered its second consecutive 25-basis-point rate cut on October 29, lowering the federal funds rate to a range of 3.75%–4%. However, Chair Jerome Powell emphasized that another cut in December is “not a foregone conclusion,” reflecting a growing divide among policymakers. The decision comes amid persistent inflation—CPI rose to 3% year-over-year in September—and signs of a cooling labor market, with hiring flatlining and unemployment edging higher. The ongoing government shutdown has delayed key economic data releases, adding to the uncertainty and forcing the Fed to rely on private sources for its outlook.

October was a relatively quiet month for U.S. stock indices, although individual stocks saw large swings with third quarter earnings season underway. AI continued to lead the overall market higher, with Nvidia becoming the first stock to reach a $5 Trillion market value. Microsoft, a 27% owner of OpenAI, provided disclosures that revealed details on OpenAI’s financials. These indicated the privately-held company OpenAI lost ~$11 billion dollars in the most recent quarter as high investment in computing and data centers dwarfs’ revenues estimated to be ~$13 billion on an annual basis according to the Financial Times. OpenAI CEO Sam Altman claimed revenues are now “well more” than $13 Billion. How long and to what extent OpenAI’s investors will be willing to fund large losses is a central question for the AI stock rally. OpenAI is aiming for new revenue lines, investor fundraising, and debt to support ~$1 trillion in spending commitments in the years ahead.

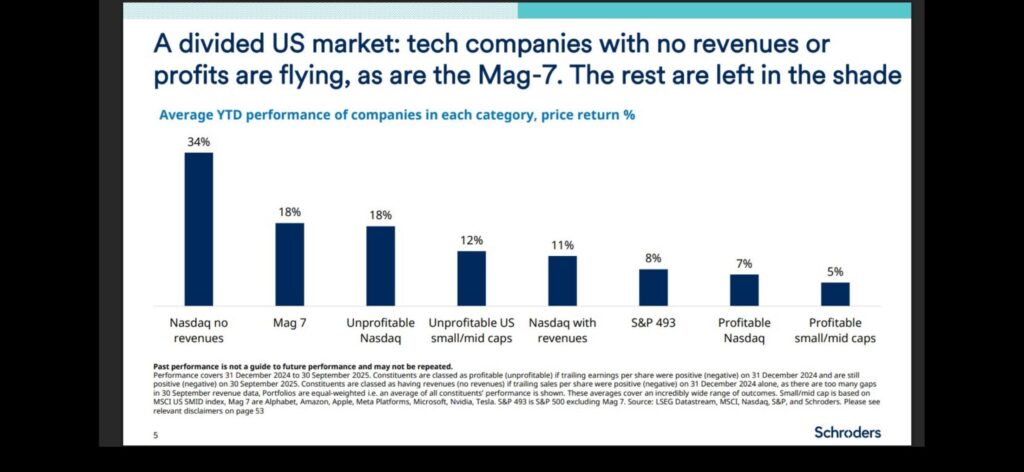

The chart below runs through the first three quarters of 2025, highlighting the investor shift to more speculative stocks. Stocks on the tech-heavy Nasdaq with no revenue were up 34%, while profitable Nasdaq stocks registered a more modest 7% return. Such divergence is not the historical norm.