With the stock indices setting new records on what seems like a daily basis many investors find themselves wondering if this is just the calm before the next storm. It can be hard to commit to the market when many pundits are predicting the next bear market is just right around the corner. We are currently not in that camp and regardless, past data shows that even if this is true the stock market has still proven to be a sound investment.

Investors contemplating whether to put new cash to work may take solace in this fact: if you invested in the S&P 500 index at the pre-Financial Crisis peak you have now doubled your money. That’s right! Since October 9, 2007 the total return for the S&P 500 index is 104%, or 7.4% annualized. Like investors who stuck with it through the 2008 crash, historical data has shown that long-term investors that have weathered short-term corrections have still come out ahead.

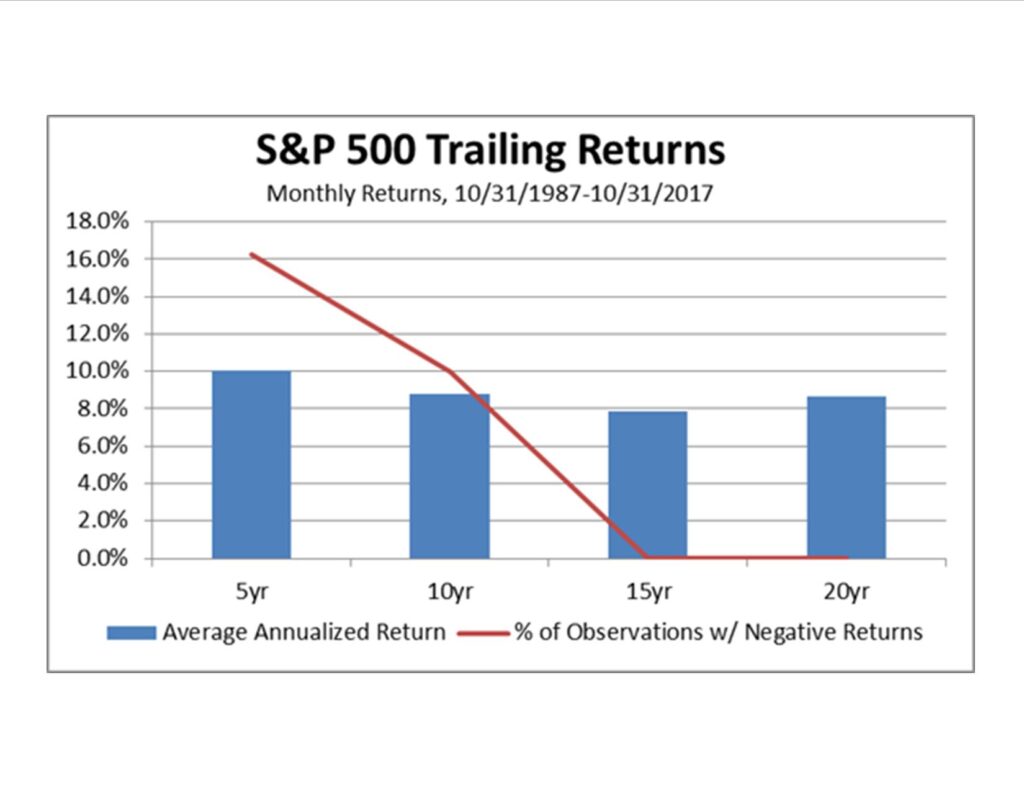

Looking at monthly returns over the past thirty years through the end of October, a five year investment in the S&P 500 index had roughly a 16% chance of losing money. Extend the investment horizon out to ten years and it drops to a 10% chance. At just 15 years, well within the average investor’s investable timeframe, the chance of losing money dropped to zero. Now it’s true that nobody can predict these same results going forward, but considering the 30-year time period in question includes two of the worst bear markets in U.S. history, it has to be a little more comforting.

The point is this: while timing the market obviously has its benefits, it’s next to impossible (and costly), and therefore investors should focus on time in the market. In our previous two dashboards we looked at returns during wartime and the potential costs of trying to predict market tops, respectively. Analyzing the 10-year return since the pre-Financial Crisis peak provides another example of the long-term resiliency of the stock market, with short-term corrections typically smoothed out over time.

Elliott Holden, CFA