This month’s macroeconomic discussion is centered on the recent government shutdown, Federal Reserve policy, and consumer dynamics. The longest government shutdown in U.S. history concluded after 43 days, following Congress’s approval of a stopgap spending bill effective through January 30. While the shutdown itself was not a major market driver, it resulted in a significant reduction in economic data availability. For example, the Bureau of Labor Statistics postponed the October payroll report, with November’s report now scheduled for release on December 16—after the December FOMC meeting. This data gap has contributed to volatility in rate-cut expectations, as some Fed officials have indicated reluctance to lower rates in the near term. Consequently, December implied rate-cut probabilities were pushed below 30% in the week of November 17. However, dovish comments made by NY fed President Williams on November 21st triggered a strong reversal, sending December rate cut probabilities above 80% for the final week of the month. Consumer trends remain a focal point, with increasing evidence of bifurcation and a “K-shaped” economy. The administration has signaled concerns regarding affordability, exploring measures such as 50-year mortgages, $2,000 tariff dividend payments, shifting health insurance subsidies to individuals, and targeted tariff exemptions.

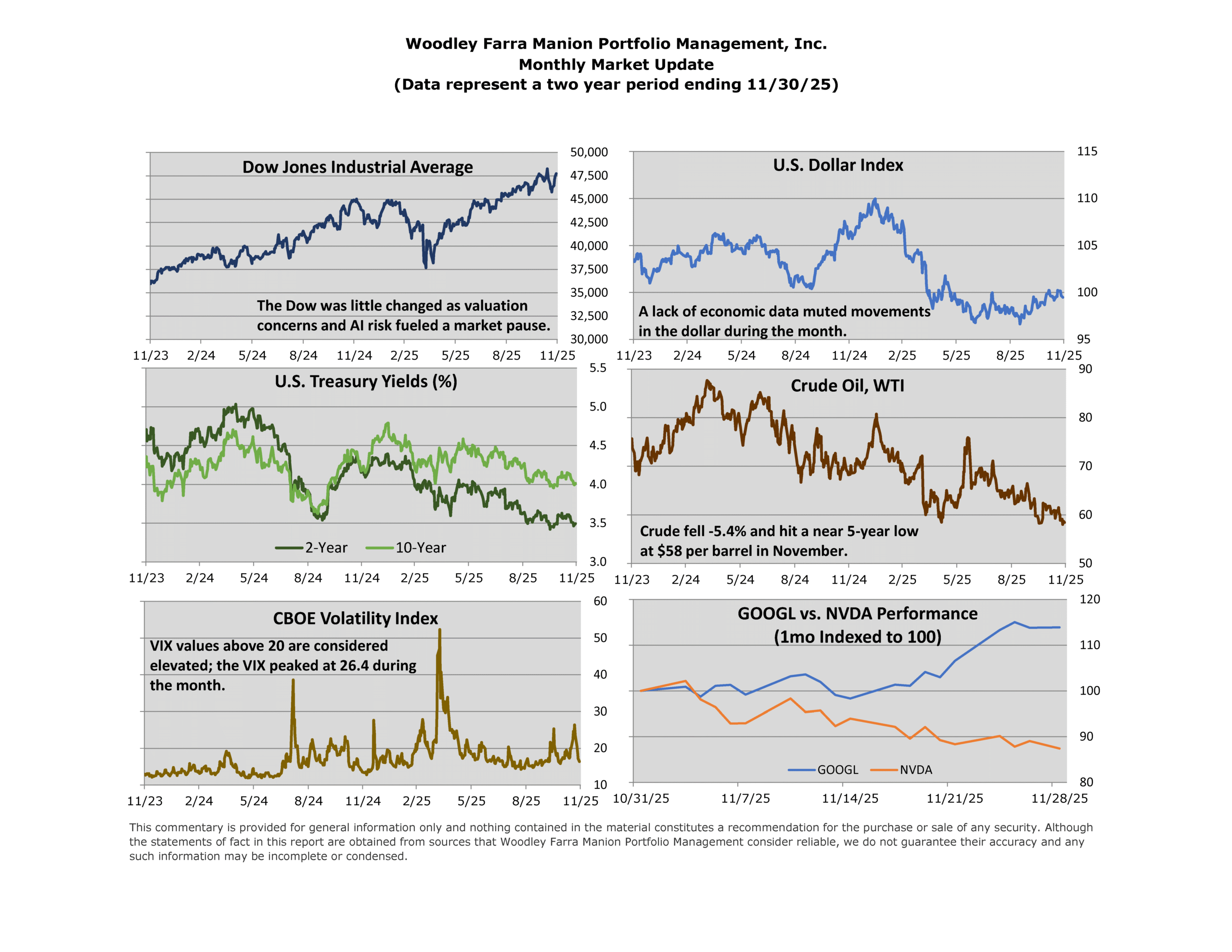

The S&P 500, Nasdaq, and Dow Jones Industrial Average were in negative return territory for most of the month with two of the three indices closing positive. The Dow Jones lead this month up 0.32% followed by the S&P 500 up 0.13% and the Nasdaq down -1.51%. All three US indices remain positive year-to-date. Volatility was largely driven by heightened scrutiny of artificial intelligence (AI) firms, which triggered moves lower in U.S. equities. Companies with high short interest, crypto exposure, and quantum computing ties were among the hardest hit. Investor concerns around AI have focused on cash burn, leverage, circularity, and return on investment. Despite these headwinds, NVIDIA delivered strong third-quarter results, surpassing consensus estimates on both revenue and earnings. Management also raised forward guidance and highlighted a robust order pipeline, signaling sustained demand in its core markets. Alphabet’s AI team launched Gemini 3 in November, and it has been a huge market mover. Gemini 3 surpassed ChatGPT 5.1 across third party AI benchmarks. It’s important to note that Gemini 3’s impressive performance is being driven by internally designed TPUs (Tensor Processing Unit) and not Nvidia GPUs. TPUs are highly efficient, fast for large scale neural network training and inference, and offer strong performance per watt for AI tasks.

-Nicholas V. Thomas