The election is finally over and like us you probably noticed a result not unlike the Brexit vote: the outcome probably surprised you, no matter which side you voted for, and after a large initial decline the stock market quickly rebounded. The S&P 500 had a 3.70% total return for the month, crossing 2,200 for the first time ever and the Dow Jones Index crossed 19,000 for the first time in its history. While stocks responded positively, the bond market fared much worse. After digesting the news of a Trump victory, an overarching theme that drove investment returns was susceptibility to higher interest rates.

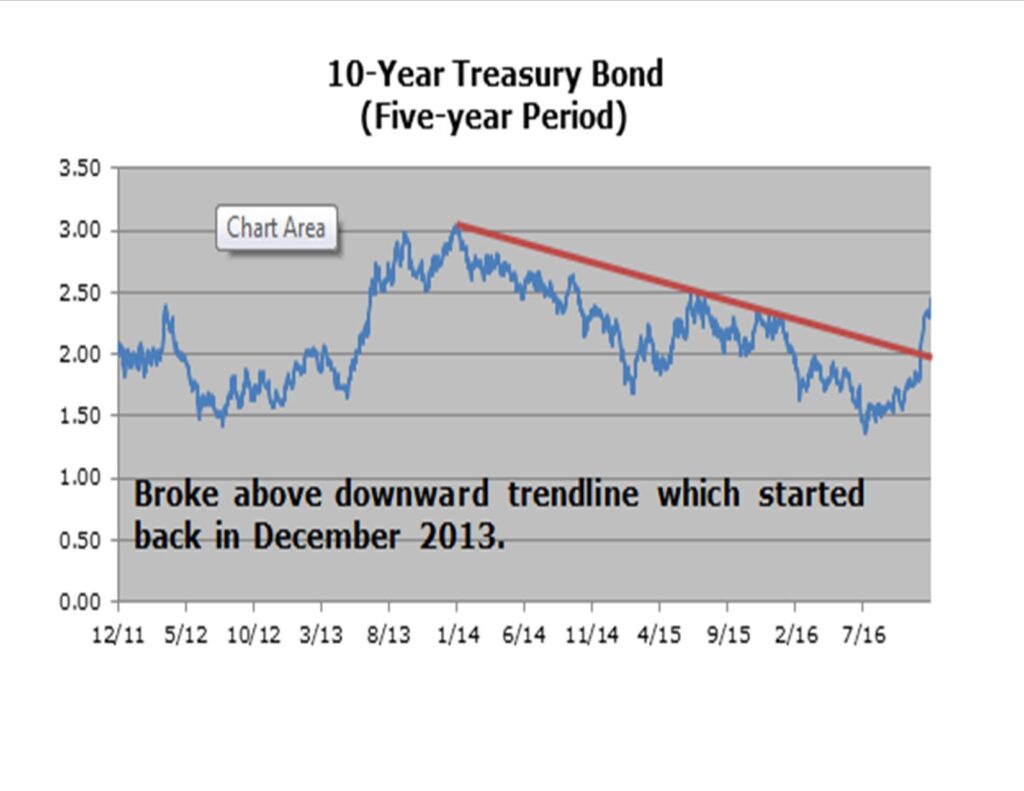

One expectation under a Trump presidency is for more fiscal stimulus, higher inflation, and therefore higher interest rates. The US Treasury 10-year yield increased from 1.86% to 2.36%, the highest yield since July 2015. Within the past five years this move represents a break above the downward trendline that started back in December 2013 when the yield peaked above 3%. We believe the end of ultra-low US rates may finally be here. We recognize that rates are still historically low (and even in the past ten years the 10-year US treasury yield was above 5%), but economic fundamentals and technical indicators both signal that yields may have bottomed. It’s also important to keep an eye on global interest rates. Ultra-low (and even negative) interest rate policies around the world may prevent domestic rates from increasing too much.

Rising interest rates will be welcomed by some parts of the market, though troublesome to others. Retirees and other income investors will appreciate higher fixed income yields. Insurance companies and banks will also benefit from increasing rates as banks should see an increase in their Net Interest Margin (NIM), the difference between the interest they charge on loans and what they pay on deposits. On the other hand, an increase in mortgage rates may affect those looking to purchase a new home and could slow down the overall housing recovery. We’ll most likely see a slowdown in corporate debt issuance as well, after nearly five years of record issuance. Any CFO who chose not to refinance may be kicking themselves in a few years, or will be out of a job. Rising rates could also put more pressure on government finances due to higher interest costs. Overall, faster economic growth should “trump” the cost of higher interest rates!