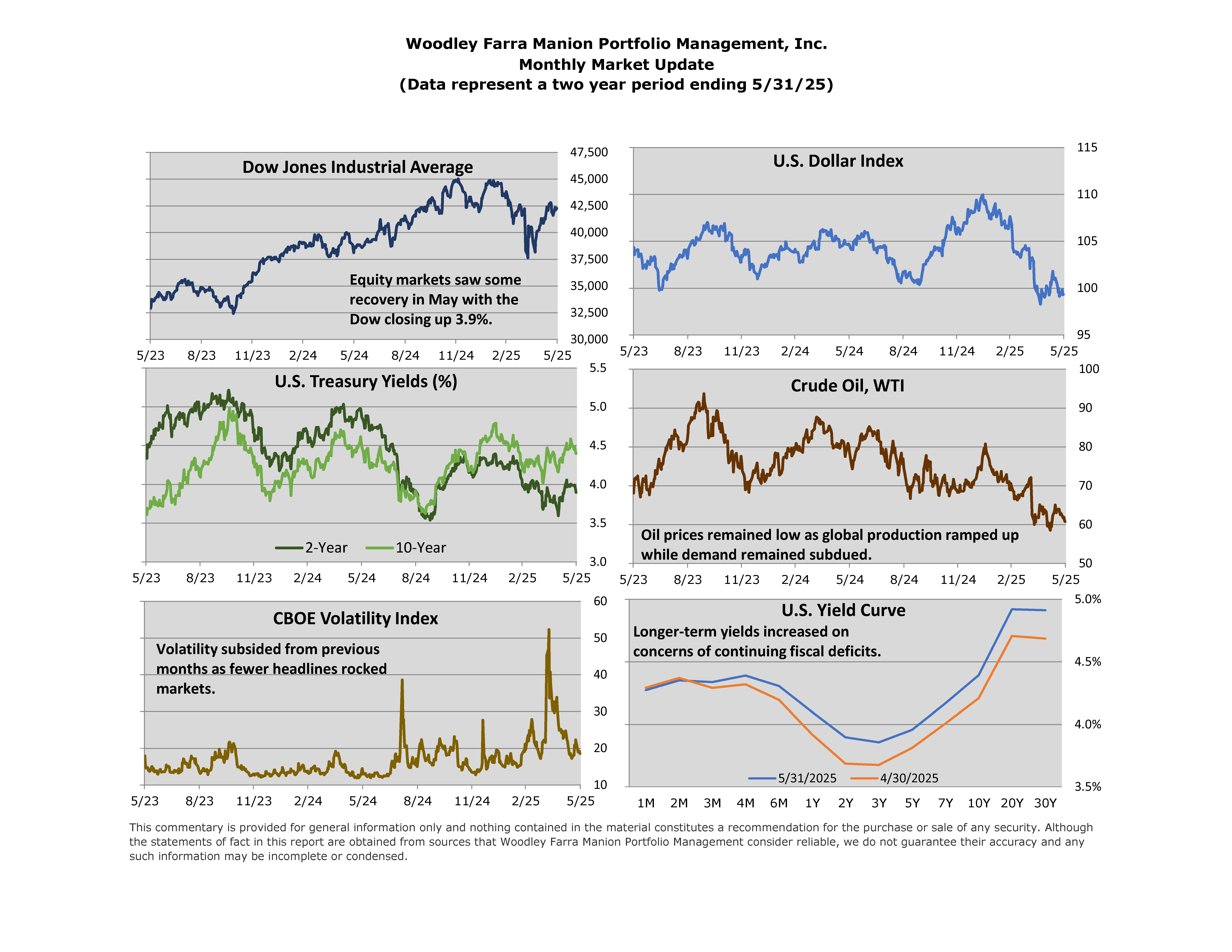

Stock markets recovered in May with the S&P 500 closing up 6.3%. Year-to-date the S&P 500 is now up, albeit only 1.1%. A stronger than expected earnings season and favorable tariff news were contributors to the recovery. News related to U.S. budget deficits also impacted markets. The last of the three major credit rating agencies, Moody’s, downgraded U.S. debt from their highest possible rating (Aaa) rating on May 16th. On May 21st, the House passed a bill which would see the U.S. continue to run large deficits-to-GDP for several years. The bill was being hotly debated at month end. U.S.10-year treasury yields briefly moved higher after the downgrade and house bill passing, but ended the month at 4.4%; unchanged vs May 15th.

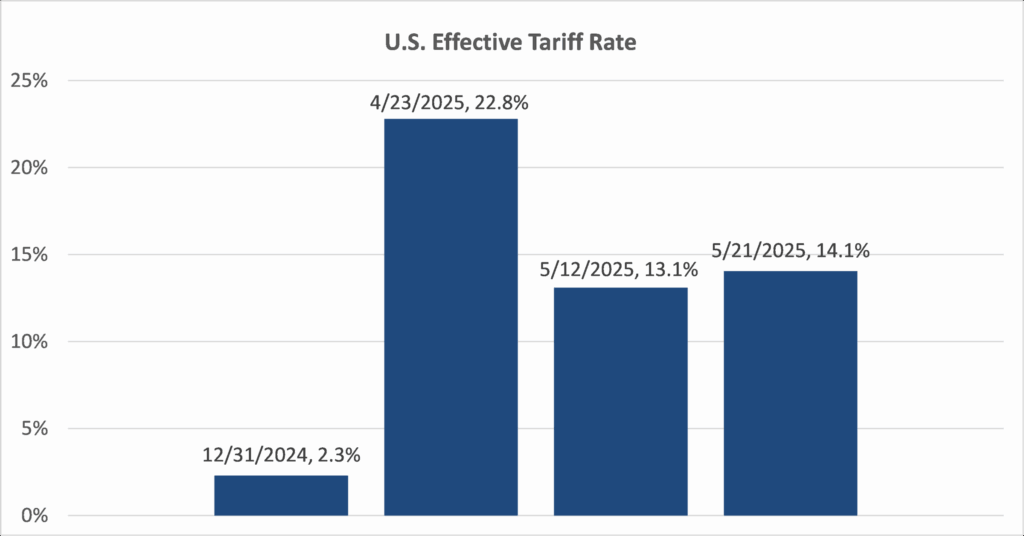

The current tariff situation can be summarized in one word: dynamic. Since “Liberation Day,” the evolving tariff rates and product category carve outs have led to an important economic question: what is the U.S. average (effective) tariff rate? As of May 21, 2025, Fitch Ratings estimated the effective U.S. tariff rate on global imports was 14.1%. The chart below best summarizes the dynamic tariff situation that has played out so far this year. While the effective rate has fallen since the April peak, it remains over ten percentage points higher than where it was at the end of 2024 and the highest it’s been since the 1930s. The S&P 500 is up 19% since the April 8th low that coincided with >20% effective tariffs. The last two months serve as a reminder of the importance of maintaining a long-term focus during volatile periods.

Source: Fitch U.S. Effective Tariff Rate Monitor

Jared J. Ruxer, CFA, MS and Levi I. Gates