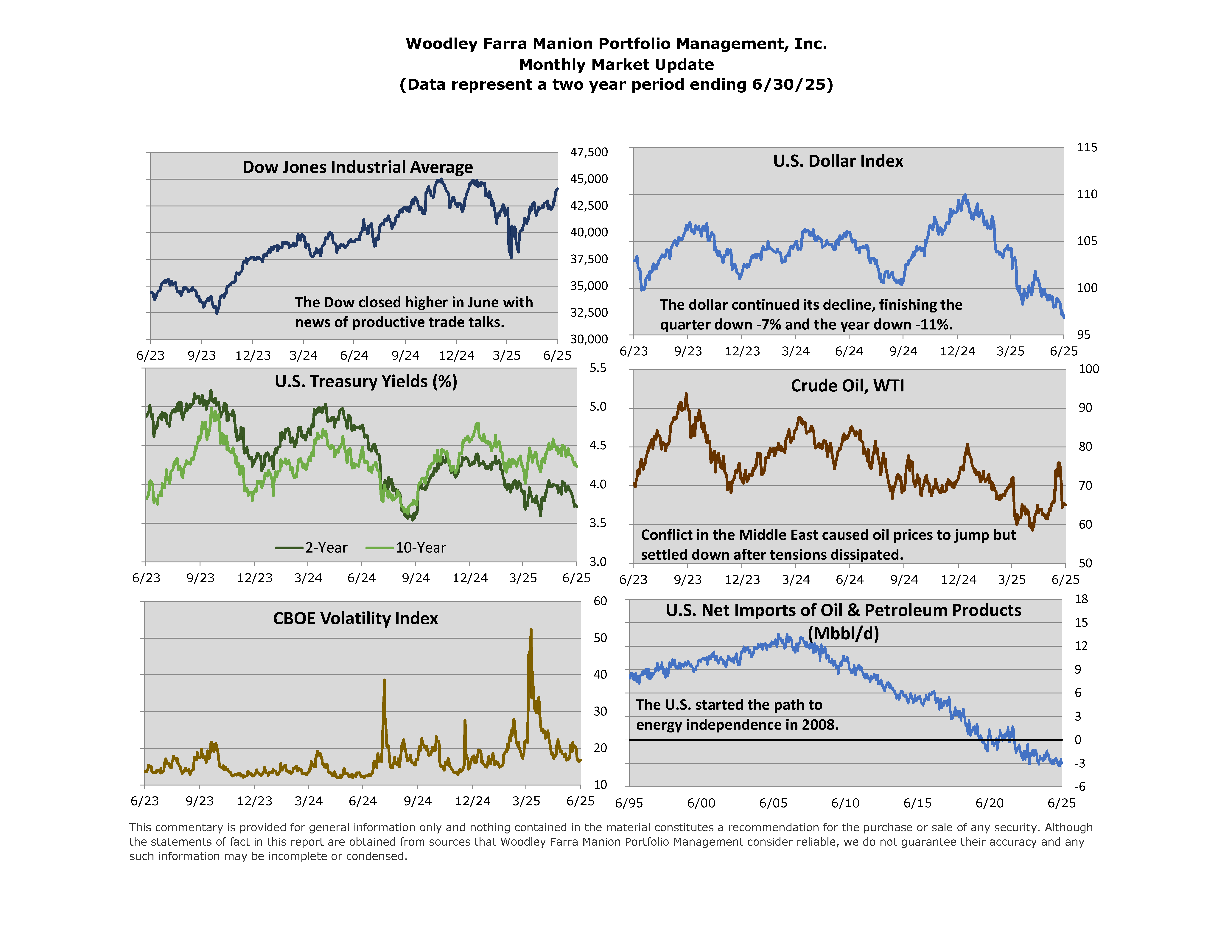

Stocks saw steep declines early in the second quarter as the severity of the April 2nd tariff announcements caught investors by surprise. These new tariffs included broad-based import duties as well as targeted levies on steel, aluminum, and autos. By April 8th, the S&P 500 was down 11.2% from the start of the quarter and 15.3% on the year. As the quarter proceeded, trade tensions cooled, and the S&P 500 bounced back to new all-time highs. Much of the easing trade tensions can be attributed to delays and suspensions of new tariffs. Investors will be closely watching the upcoming deadlines and ultimate outcomes from tariff negotiations. In April and May, the only two months with available data since the tariff announcements, the Federal Reserve’s preferred inflation measure rose at an average annualized rate of 1.9%, in line with their 2% target. The Federal Reserve will closely watch inflation data in case tariffs take time to translate into higher consumer prices. An uptick in inflation would likely result in the Federal Reserve holding off on interest rate cuts for longer.

Geopolitical tensions intensified in the Middle East, but through the end of June resulted in minimal disruption to oil infrastructure and trade in the region. Unlike previous decades, the U.S. economy is significantly more insulated from oil-price shocks. Today, the U.S. is a net exporter of over 2.5 million barrels per day of oil and petroleum products—a stark contrast to its position as a ~12.5 million barrels-per-day net importer in the mid-2000s. This shift substantially immunizes the U.S. economy against energy-related geopolitical shocks. Oil prices saw a short-lived uptick in June as conflict escalated only to fall back by quarter end.

We hope you have a Happy Fourth