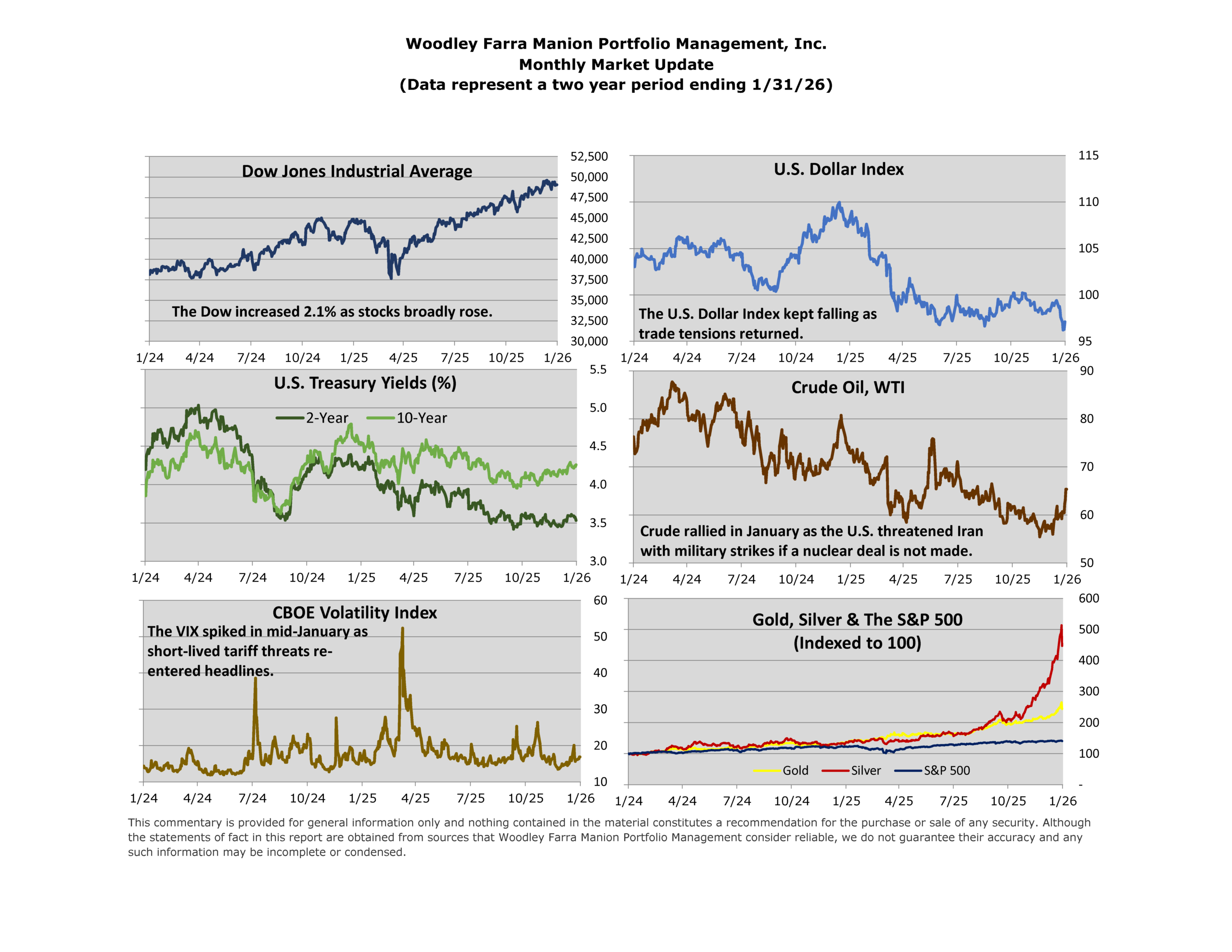

January marked a solid start to the year for markets with the S&P 500 closing up 1.4% and the Dow Jones closing up 2.1%. Unlike the concentrated trend of 2025, stocks seemed to broadly rise with the equal weight S&P 500 index outperforming the traditional S&P 500, which is weighted based on market size, by 2.2 percentage points. Some of the biggest tech names took a breather after a stellar 2025, with the Magnificent Seven only seeing an average increase of 0.4% in January.

Gold and silver received a lot of buzz in January as they continued chugging ahead after an impressive run in 2025. Gold was up 67% while Silver increased a staggering 149% in 2025. Those returns dwarfed the historically impressive annual return of 16% the S&P 500 enjoyed last year. The precious metals buzz resembled the multi-year excitement around cryptocurrencies. Bitcoin, the most popular cryptocurrency, is down 24% over the last twelve months.

Gold’s strong performance was attributable to immense demand from central banks and professional and retail investors alike. The unusually high demand for gold came because of weakening trust in the U.S., the dollar, and treasuries. Uncertainty on the direction of the U.S. arose from fluid tariff policies. Additionally, the aggressive stance the U.S. took on foreign policy incentivized increasing gold reserves over U.S. treasuries. On the investor front, many professional investors chose to buy gold in place of bonds as an investment hedge for similar reasons as foreign central banks. Retail investors also invested heavily in gold. In 2025, $89 billion flowed into physically backed gold ETFs, the highest ever, according to the World Gold Council.

Silver on the other hand, saw prices skyrocket from the perfect storm of a five-year structural supply deficit, strong industrial demand, geopolitical hedging, and retail interest. Silver is a key industrial component in electric vehicles, solar panels, and AI servers. Additionally, like with gold, investors piled into ETFs hoping to ride prices higher.

After a stellar 2025, investors may be tempted to hop into gold and silver with hope that momentum continues. The danger of this is not properly understanding the risk these assets carry. A perfect example of this took place on Friday, January 30, when SLV, a silver ETF, plummeted 28.6%. The impressive returns of 2025 can quickly turn into staggering losses for investors who are not aware of the dynamics of Silver and gold. Remember, silver and gold are not cash-flowing assets. In fact, investing in these metals comes with significant costs either through the cost of purchasing and rolling futures contracts or through physically paying to store them. Over time metals tend to underperform stocks with the S&P 500 outperforming over the last 40 years by an annualized 2 percentage points. As with all assets, investors should make sure they fully understand the risks before choosing to allocate money towards it.

-Levi I. Gates