It finally happened! After flirting with the elusive 20,000 level for six weeks the Dow Jones Industrial Average finally crossed the mark at the end of January. Networks plastered the number all over their broadcasts and traders created hats, but what does it all really mean? Frankly, not a whole lot. It’s a nice round number that represents a new all-time high, but if you look at the S&P 500 it also reached a new all-time high, but at the much less marketable level of 2,298.

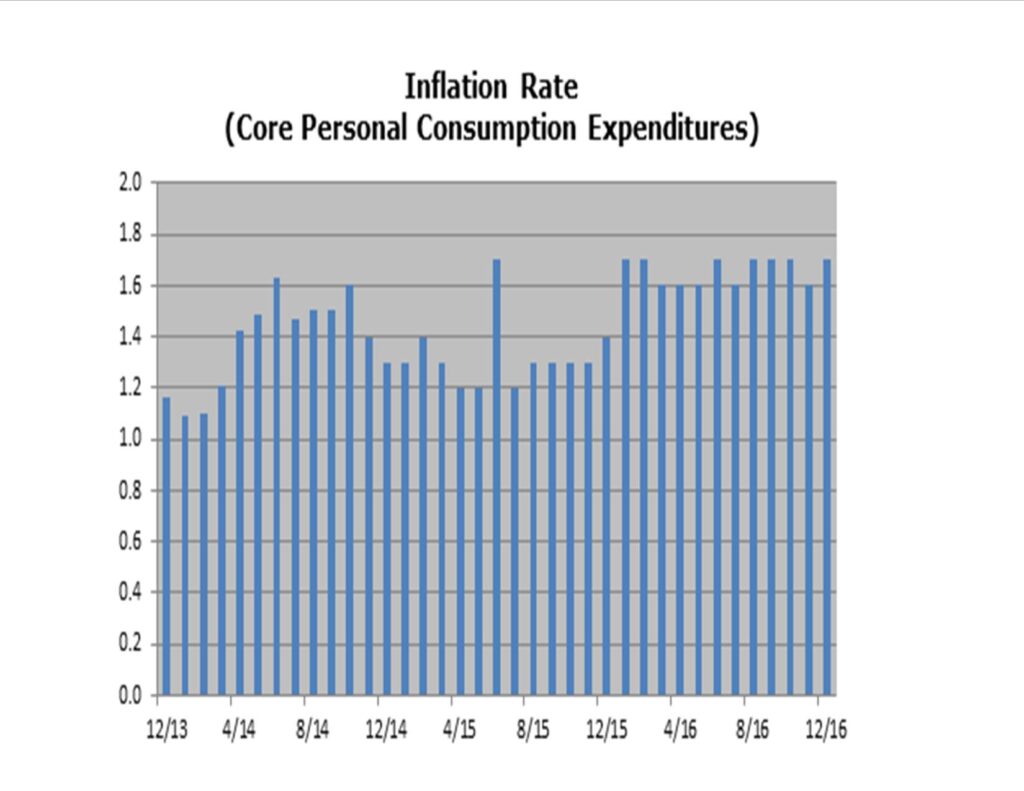

Investors have driven the indices to new highs partly due to expectations that the new administration will lower taxes and increase fiscal spending (eg. infrastructure and defense spending), all in an effort to ramp up economic growth. As all of this unfolds something to keep an eye on is inflation, and ultimately the Fed’s reaction to it. While economic growth sounds great, if inflation gets out of hand it can quickly derail an expanding economy. So where is inflation now? Well, the Fed looks at different measures of inflation but their preferred measure of inflation is still below 2%, their long-run target. So, as we think through the political and fiscal policy changes we see a looming balancing act between the Fed aiming to maintain inflation around 2% and promoting a growing economy.

Let’s look at a few examples of where higher inflation could come from based on fiscal policy expectations:

- If income taxes are lowered consumers will have more money to spend;

- If corporate taxes are lowered companies will have more money to invest;

- A stricter immigration policy could produce a shortage of “cheap” labor which could drive up wages;

- Increased government spending uses money not already in the system so the money supply increases.

At home, an increase in the labor force participation rate for men (which is still near an all-time low) could offset some wage increases, and globally an economic crisis could have a contagious effect that slows domestic growth and inflation. But, the Fed still has a strict mandate to maintain price stability. The Fed has already stated that they could raise rates three times this year. Whether they choose to or not, it’s the timing of rate hikes that will be crucial in preventing inflation from increasing too much while not hindering economic growth.