Stocks posted another year of gains in 2025. As investors look to 2026, many of the same core themes apply: tariff policy, interest rates, and AI. The April tariff-driven selloff, which pulled the S&P 500 down 15% earlier in the year, proved short-lived as concerns regarding corporate profits and consumer spending failed to materialize. In fact, S&P 500 profits are expected to rise 8% in 4Q’25 compared to the previous year, according to FactSet. Consumer resilience was further evidenced by Visa and Mastercard, which reported U.S. holiday retail sales up 4.2% and 3.9%, respectively. Currently, the White House’s reciprocal tariff policy (IEEPA) is under review by the Supreme Court. Betting markets point to a 1-in-3 chance the administration succeeds in keeping these tariffs. The Yale Budget Lab recently estimated the average effective U.S. tariff rate at 16.8%; if the IEEPA tariffs are struck down, this rate is expected to drop to 9.3%.

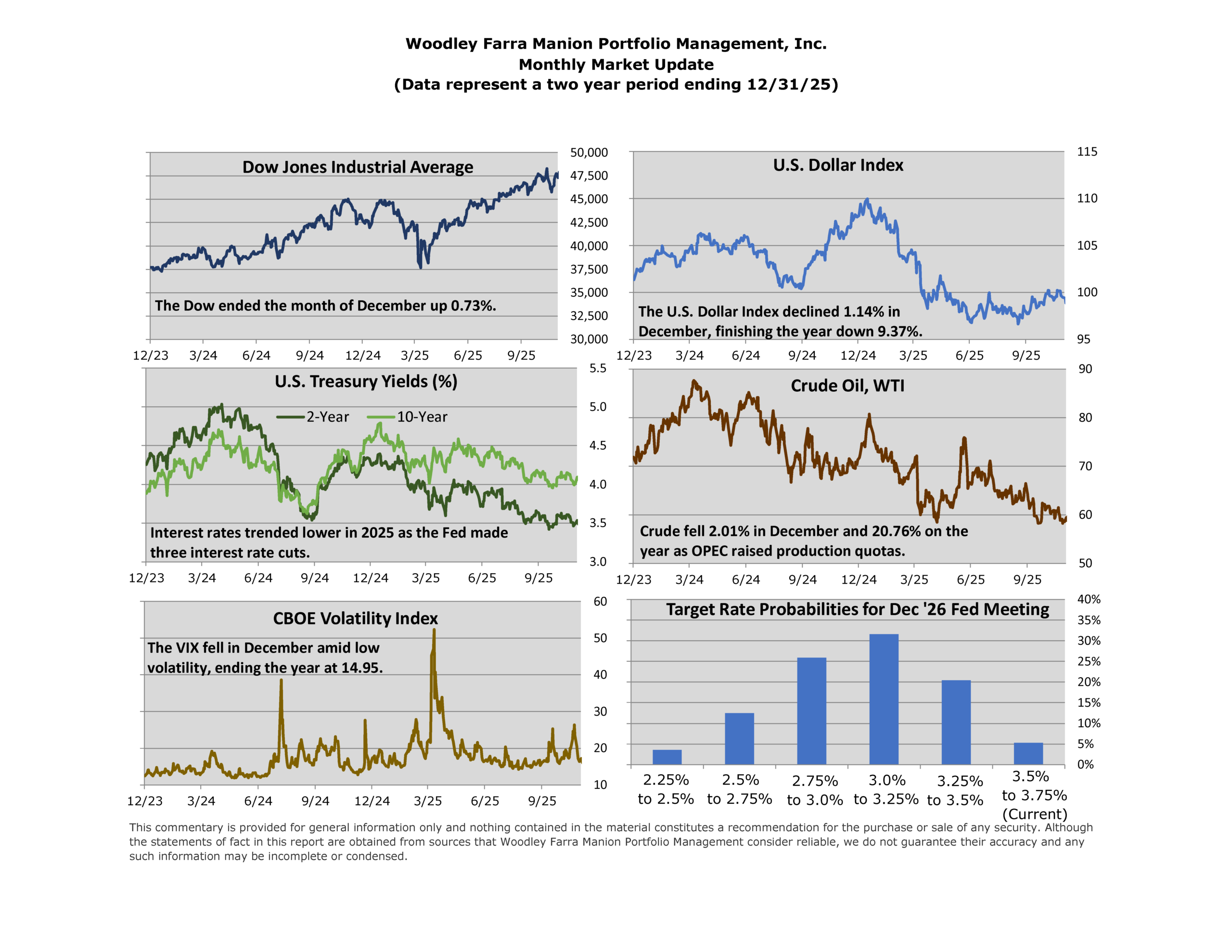

Falling interest rates provided a tailwind to markets in 2025. The Federal Reserve cut the short-term benchmark rate in September, October, and December, totaling 0.75% in cuts. Longer-term rates also dropped, with the 10-year US Treasury yield 0.43% lower on the year. All else equal, lower interest rates support higher valuations and earnings for stocks. Looking ahead, interest rate futures imply a ~75% chance of at least another 0.5% in rate cuts in 2026.

Perhaps the biggest obstacle entering the new year is the burden of high expectations. Years of robust returns can create complacency and spur risk-taking. According to FactSet, Wall Street analysts are expecting 15% earnings growth for the S&P 500 in 2026—a high bar compared to the 8.6% average annual growth rate seen from 2015-2024. With a large part of the index dependent on AI, any signs of disappointment—whether through slow enterprise uptake or intensifying competition—may pose a risk. Rather than chasing speculative growth to meet aggressive forecasts, we remain committed to owning high-quality companies with the balance sheet strength to navigate uncertainty.