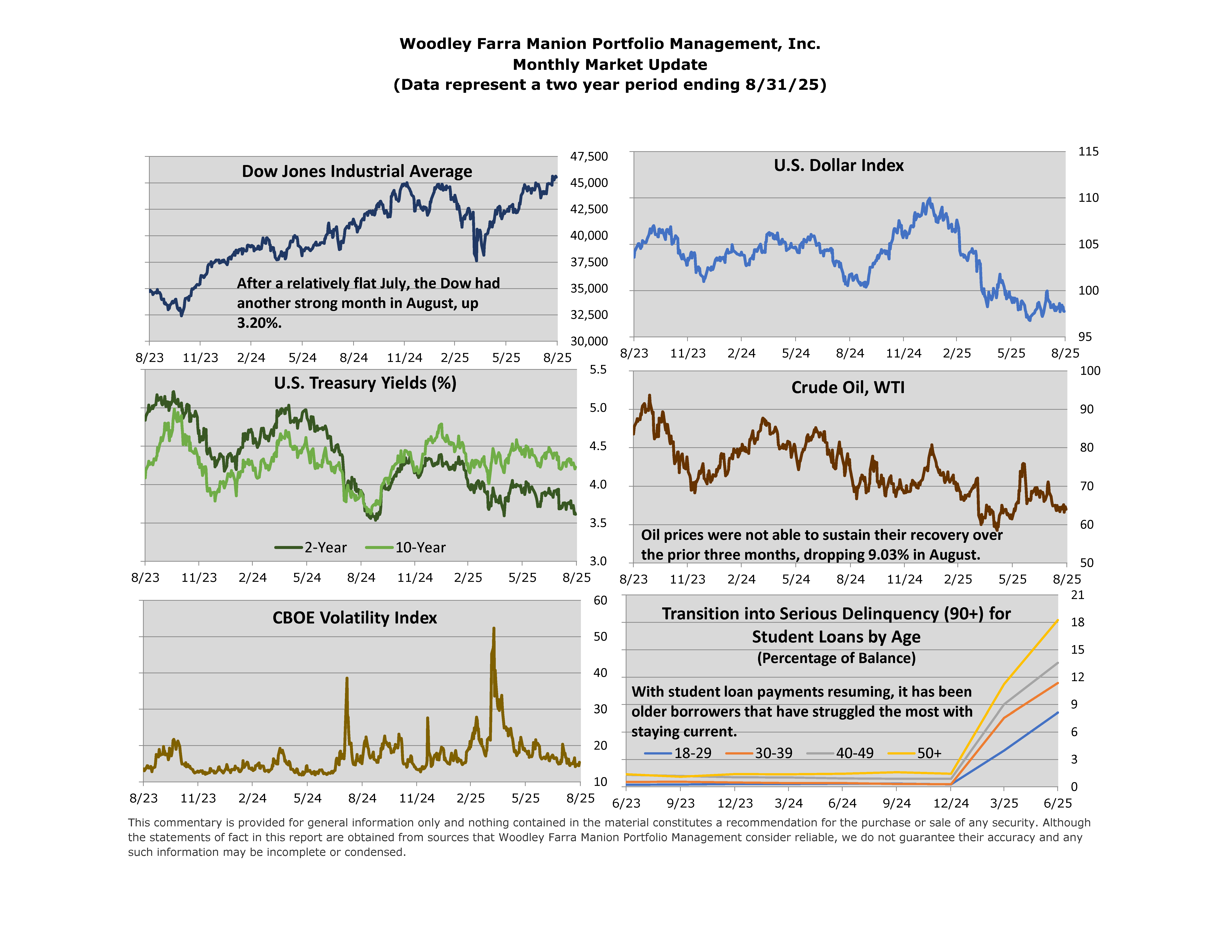

U.S. stocks continued to grind higher in August, with the S&P 500 advancing 1.9% and notching a new record high late in the month. The Dow and Nasdaq also posted gains, marking the fourth consecutive monthly increase for the major indices. Volatility remained muted as investors weighed a mix of softer labor data, ongoing debate over the pace of artificial intelligence adoption, and shifting expectations for monetary policy.

The highly anticipated launch of OpenAI’s ChatGPT-5 early in the month captured headlines but underscored both the promise and the challenges of AI. CEO Sam Altman said after the release “Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes. Is AI the most important thing to happen in a very long time? My opinion is also yes”. That sentiment was echoed in a recent MIT survey showing that despite $30–40 billion in enterprise investment in generative AI, 95% of companies report no tangible return to date. The study highlighted persistent shortcomings around tools that fail to integrate with existing workflows, lack memory, and are quickly abandoned for mission-critical tasks. Until this “GenAI Divide” is bridged, investment is likely to remain ahead of productivity gains.

On the economic front, the labor market showed further signs of cooling. From January 2023 to January 2025, roughly 84% of the 3.7 million jobs created came from foreign-born workers. With immigration slowing and prime-age participation already near record highs, the potential for large job gains is limited. Participation among younger workers remains well below historical norms, leaving that group as a potential but uncertain source of future growth.

Against this backdrop, the Federal Reserve signaled it may soon adjust course from the current wait and see approach to interest rates. In his August 23 remarks at Jackson Hole, Chair Jerome Powell noted that with policy in restrictive territory, the shifting balance of risks may warrant a change in stance. Futures markets now imply nearly a 90% chance of a quarter-point rate cut at the Fed’s September 16-17th meeting. Taken together, August reinforced the market’s resilience in the face of policy uncertainty, a moderating labor market, and a dynamic AI outlook. With valuations elevated and September historically a more volatile month, we remain attentive to both risks and opportunities as we move into the fall.

-Jared J. Ruxer, CFA, MS