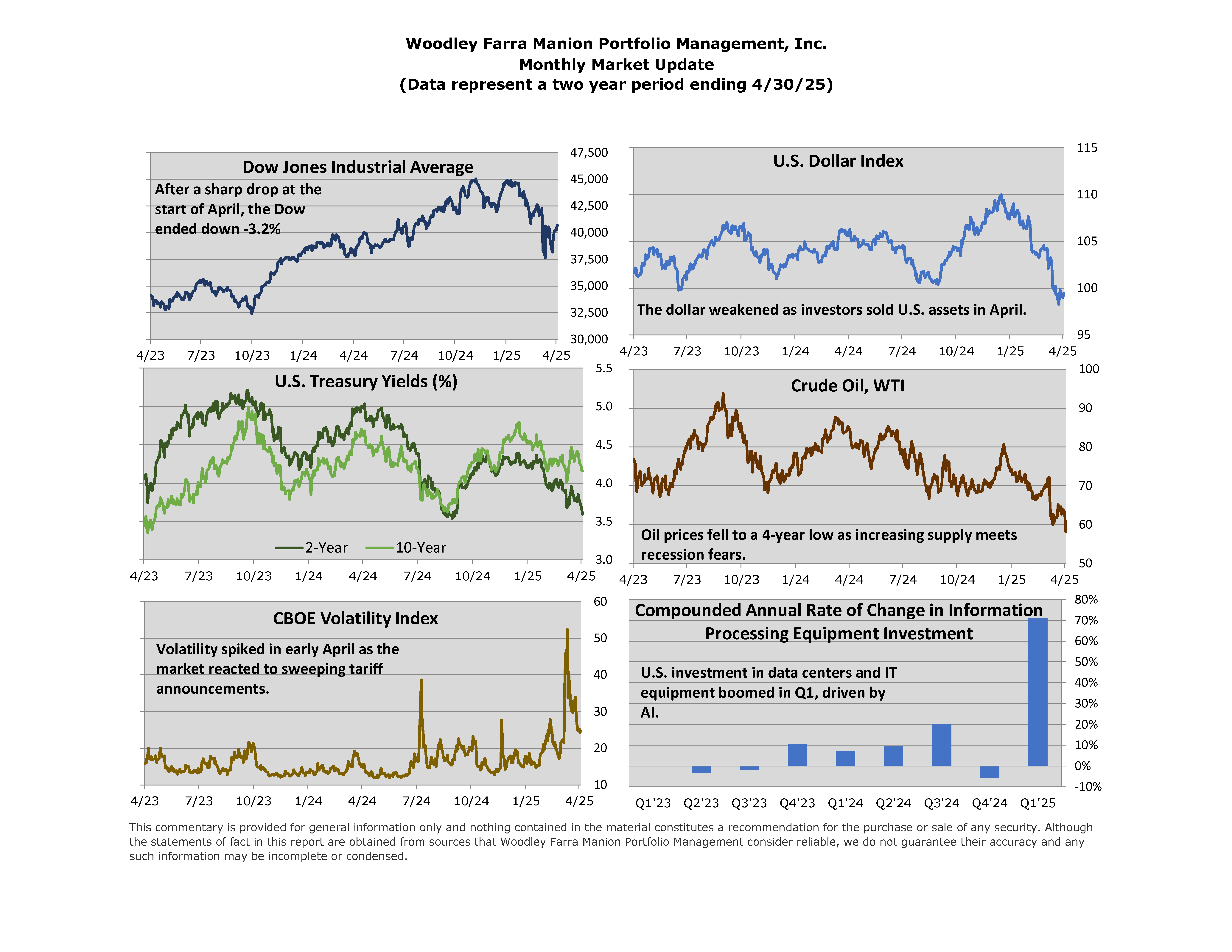

The month of April produced the highest level of stock market volatility in recent memory. The announcement of higher-than-expected tariffs on imports coming into the U.S. on April 2nd triggered a nearly 15% drop in the S&P 500 in three trading days. The bottom on April 7th did prove to be the low point for the month, and by April 30th the S&P had regained nearly all its decline.

The initial surprise of the level of tariffs was shortly followed by announcements of a 90-day pause on most tariffs (except China) and the commencement of intensive negotiations with many countries to reduce or even eliminate tariffs on both sides and improve access to foreign markets to more U.S. goods. The corporate reaction was mixed with some companies announcing sweeping manufacturing overhauls over the next few years, while others opted to delay major projects and take a wait-and-see approach to the tariffs.

The U.S. has had a trade deficit for most of the post-World War II era. Sellers of goods and services to the U.S. are paid in U.S. dollars. Most of those dollars are invested back into the U.S. in the form of buying U.S. Treasury bonds, thereby financing a good portion of the ongoing federal budget deficit. Reducing the budget deficit can have the benefit of helping reduce the trade deficit. A lower budget deficit will also reduce the government’s role in the economy back to more traditional levels. Stock market volatility has so far been driven more by headlines rather than economic developments. Consumer and business confidence has fallen due to the tariff instability, and Q1 GDP declined -0.3% on a quarter-over-quarter basis as U.S. producers rushed to frontload imports ahead of tariff implementation. So far, employment has been steady, and inflation has seen slight moderation, though it is important to keep in mind this data is pre-tariff and may not fully reflect the current economic condition. Future economic releases will be followed closely, as will the progress on tariff negotiations.

George S. Farra, CFA